NYBOT or the New York Board of Trade was established in 1870 and its early establishment was dominated by the “open outcry” or “floor” system, where traders would have to shout or use hand signals to communicate a bid or sell. However, in 2007, the exchange was officially acquired by Intercontinental Exchange (ICE) Futures US and subsequently, all ICE Futures US trading has been done via the electronic trading system.

Investors can find different forms of derivatives that spans fields such as agriculture, digital assets, energy, equity derivatives, FX, and metal. Among these choices, some of the popular contracts traded on ICE Futures US include commodities futures such as sugar No.11 futures and index futures such as US Dollar Index Futures.

With the variety of products available, this article will cover some of the key facts about the exchange.

1. History of ICE

The Intercontinental Exchange consists of many clearing branches in countries including Europe, U.S, Singapore, and Abu Dhabi, as well as other mergers and branches such as Endex, Creditex, NYSE, Swap Trade, OTC Energy, and NGX.

The timeline of the exchange is defined by a few key acquisitions starting, for example, the acquisition of the New York Board of Trade (NYBOT) in 2007. This is followed by the merger agreement with Credit in 2008, and further into 2018, the acquisition of the Chicago Stock Exchange, and lastly a definitive agreement with Black Night in 2022, a software, data, and analytics company that serves the housing finance continuum.

Through the global markets, the exchange provides a market to manage risk and raise capital across major asset classes.

2. Access Commodity Trading in Coffee, Sugar, and Cotton Futures

As an initial acquirer of the Coffee, sugar, and Cocoa Exchange, the exchange introduced this suite of products. The focus on physical commodities continued into the exchange’s growth as it was meant to increase their position in the trading market. Currently, some of the popular products from the exchange include:

All the above commodities are highly dependent on the weather, demand, supply, and warehouse storage conditions. To understand more about the products, refer to the ICE US Sugar and Cotton Futures Prices here. (Exclusive research gathered by Shanghai Orient Futures)

3. Explore the Platforms Provided By The Exchange

The exchange offers an array of solutions that can be integrated into traders’ systems. This includes desktop and web platforms, APIS, connectivity options, consolidated data feed, files, tick history archives, and plug-in widgets.

Some of the significant solutions offered by the exchange include the ICE Risk Model. The model is a scenario-based, parameterized risk model used to evaluate the risk exposure to the Clearing House in the event of a defaulting portfolio.

4. Understand the Trading Procedures & Timings

ICE Futures US trading times are Monday to Friday, 6:05 pm – 7:25 pm ET, and 11:05 pm – 12:25 am UK local time. Or weekends on Friday 6:05 pm to Sunday 4:30 pm RT or Friday 11:05 pm to Sunday 9:30 pm UK local time.

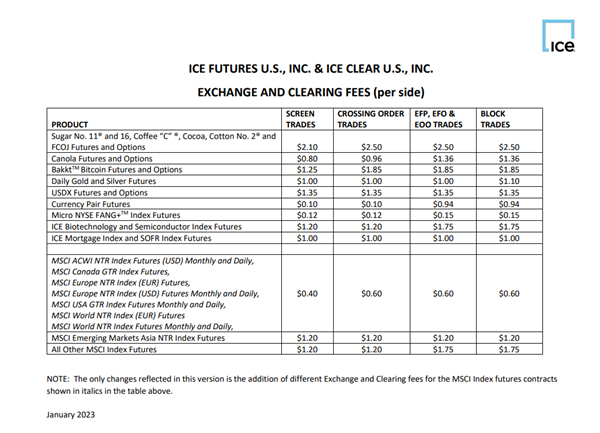

Apart from trading hours, the ICE Futures exchange and clearing fees differ amongst the products for screen trades, crossing order trades, block trades, or EFP, EFO, and EOO trades. These charges are reflected at the fees site here or in the table below.

Figure 1: Source: ICE Futures US

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG).

We provide premium customer service at an affordable cost to all our clients. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.